Do not give your house back to the bank in Mount Laurel and Surrounding Areas and surrounding areas.

Can you give your house back to the bank?

The answer is YES! (but with caveats, read below for more details)

Do Not Give Your House Back To The Bank in Mt. Laurel, and surrounding areas.

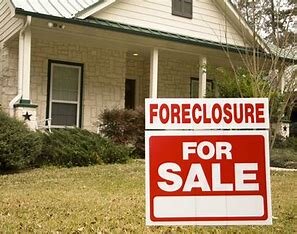

Local New Jersey homeowners who are facing a financial challenge may find themselves in foreclosure. This can be a devastating situation for families and their future. Trying to climb out of the depths of foreclosure may seem impossible. Getting ahead of foreclosure in Mt. Laurel and surrounding areas is very important.

For local NJ families facing foreclosure, the stress can be almost unbearable. Worse yet, the foreclosure process can take months or even years, stretching out the pain for longer than anyone wants.

Fortunately, you have options available to you here in NJ — perhaps more options than you realize. There are many strategies that help for foreclosure in Mount Laurel and Surrounding Areas; these are legal foreclosure avoidance strategies you can implement to help you resolve your foreclosure issue so you can get on with your life.

There are many ways to avoid an expensive foreclosure in Mount Laurel and Surrounding Areas, but giving your house back to the bank shouldn’t be one of them.

Your first step if you’re trying to avoid foreclosure in Mount Laurel and Surrounding Areas is to speak with your loan provider immediately to examine your choices to prevent home foreclosure.

You have to take action prior to getting too far behind on your mortgage payments in order to halt house foreclosure. You should contact your financial institution once you know you are likely to miss a home loan payment and inform them what is going on with your financial situation. Time is of the essence. Once the foreclosure process gets under way, and the lawyers are involved, there may not be much you can do. This is way it is so important, TO TAKE ACTION, as soon as possible.

Your mortgage loan organization would rather work something out with you so they do not generate losses on your property by going through the actual foreclosure process. It cost the bank money and time to foreclosure on your property. Do not give your house back to the bank, they really don’t want it.

You need to be open and honest with your mortgage company.

They may work something out with you that cuts down your rate of interest, which would reduce your monthly payment. In case you miss one or two payments but then are capable of start paying once again, they can usually add those repayments back to your home loan and consider you caught up on your mortgage. Do not give your house back to the bank in Mt. Laurel and surrounding areas. The financial institution will not accommodate you if you do not talk to them about what your situation is ahead of time is and asks for help.

Your mortgage loan bills or your card payments?

You’ll be able to prevent home foreclosure by ensuring you consistently pay your mortgage loan prior to any bills. Your house loan is an essential monthly bill you have. Credit cards should never take priority over your house loan repayment. You can deal with the consequences of not paying your cards a lot easier than you can the implications of failing to pay your mortgage. But do not give your house back to the bank in Mt. laurel and surrounding areas. Find a solution that will work for you.

Not paying your mortgage loan is the worst thing you can do with regard to your credit score. Getting behind on other sorts of debt like credit cards will never harm your credit as much as getting behind on your home loan. Not paying your mortgage loan could cause you difficulties with your credit cards in any case, so they ought not to be a priority when you have to pay your monthly dues.

Is selling your house in Mount Laurel and Surrounding Areas NJ a way to avoid foreclosure?

One way to prevent home foreclosure is to try to pay your house loan off by putting up your property for sale. Trying to sell your house the traditionally may take way too long and you just don’t have the time. There are better ways to approach the pre-foreclosure situation.

You could probably be free from the financial hole you are in by selling your house for sufficient cash to pay the home loan off. And sometimes you may be able to have money left to start over again. This is an excellent approach to prevent foreclosure of your Mount Laurel and Surrounding Areas house and avoid a disaster on your credit score at the same time.

Another way to stop property foreclosure in Mount Laurel and Surrounding Areas is to really cut your spending right down to the bare minimum. If you’re able to reduce your expenses adequately you could avoid having to offer to sell the house you love. For anyone who is self-employed, one method to spend less would be to stop renting an office and make a workplace at home. You could also think about selling a car and having just one that you share.

You can definitely proactively do something to stop your home from going into foreclosure and harming your credit and financial situation even further. Do not give your house back to the bank in Mt. Laurel and surrounding areas. The devastating effects of foreclosure can last many years and disrupt your future. We Buy Local Mount Laurel and Surrounding Areas Houses… Can We Make You An Offer?

Here at Ed Buys Houses, we buy houses in Mount Laurel and Surrounding Areas NJ and surrounding areas and we may be able to help you get out of your house and avoid foreclosure.

The process is really simple:

- Fill out the form over here, or call us at and we’ll make you an offer within 24 hours

- If you accept the offer we’ll get the documents drawn up and come out and visit you in your home to go over the paperwork

- We buy your house when you want us to (in as little as 7 days) at a reputable local closing agent

That’s it!